Investing in gold bars is an excellent way to diversify your portfolio, secure long-term wealth, and hedge against economic uncertainties. If you’re interested in adding gold bars to your assets, searching for places to “buy gold bars near me” can help you find reputable, convenient, and local purchasing options. Here’s a breakdown of what to expect, where to go, and how to make the most of buying gold bars nearby.

Why Buy Gold Bars Locally?

Buying gold bars from a local dealer has distinct benefits:

Immediate Access and Security: When you buy locally, you can inspect the buy gold bars near me gold bar in person, ensuring its quality and authenticity. Local purchases also avoid the risks associated with shipping precious metals, like potential loss or damage during transit.

No Shipping Fees: Buying in person allows you to avoid the costs of shipping and insurance. For heavy or high-value bars, these fees can add up quickly, making local purchases more cost-effective.

Personalized Assistance: Local dealers often offer one-on-one guidance, which is helpful if you’re new to gold investing. They can provide information on gold bar types, pricing, and storage options, allowing you to make an informed decision.

Community Connections: Building a relationship with a local dealer can provide long-term benefits, such as insider tips, fair buyback options, and updates on new inventory.

Where to Buy Gold Bars Near You

When searching for “buy gold bars near me,” you’ll typically find a few types of reputable businesses that offer gold bars:

Bullion Dealers: Dedicated bullion dealers specialize in gold, silver, and other precious metals. They often offer a wide variety of bar sizes, from small 1-gram bars to larger, investment-grade 1kg bars. These dealers are generally knowledgeable and can guide you through the entire buying process.

Jewelry Stores: Many jewelry stores carry gold bars, particularly those of smaller weights, like 10g or 20g bars. While their focus is often on jewelry, some jewelers offer investment-grade gold bars, especially during peak buying seasons, like the holidays.

Banks and Financial Institutions: In certain countries, banks sell certified gold bars as a secure investment option. While banks may charge higher premiums than other dealers, they provide an added level of security and trust.

Coin Shops: Coin shops frequently deal in precious metals and may have a selection of gold bars alongside collectible coins. These shops are often good places to find trusted brands and get insights into the gold market.

Pawn Shops: Some high-end pawn shops also offer gold bars, though this is less common. While prices may vary, a reputable pawn shop can be a quick and convenient option.

Auctions and Estate Sales: Occasionally, you may find gold bars at auctions or estate sales. While this approach can yield unique finds, it requires extra caution to verify authenticity.

What to Consider When Buying Gold Bars Nearby

If you’re ready to purchase gold bars locally, here are some factors to keep in mind to ensure a secure, profitable investment:

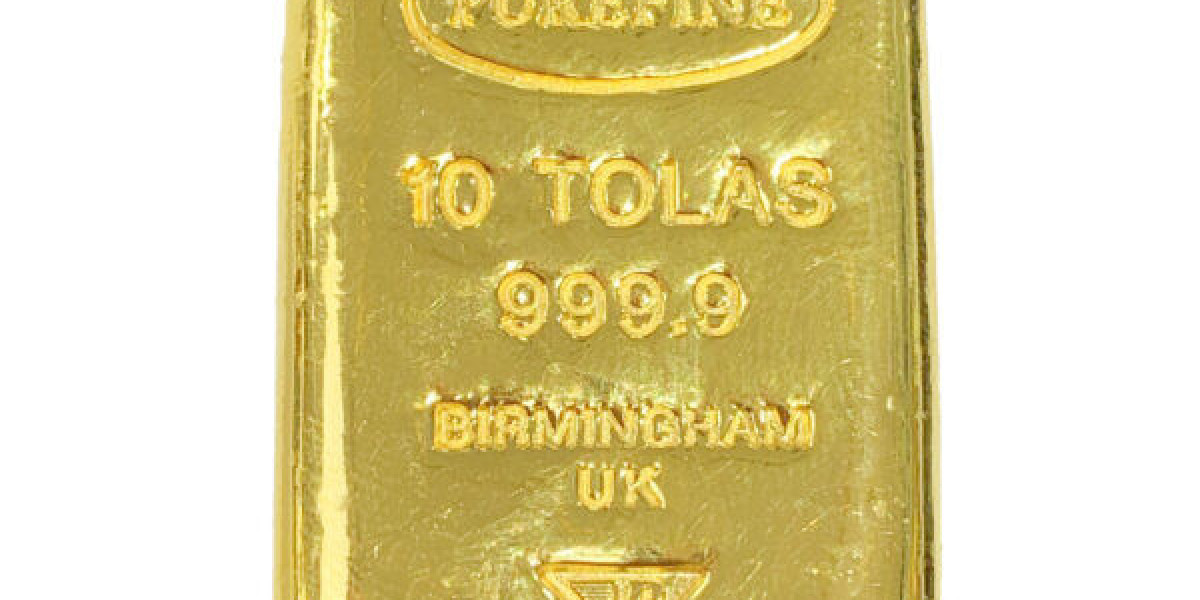

Purity and Certification: Most investment-grade gold bars have a purity level of 99.99% (often marked as “999.9”). Look for certified bars from reputable refiners such as PAMP Suisse, Valcambi, or the Royal Canadian Mint, which are widely recognized and accepted worldwide.

Pricing and Premiums: Gold bars are typically sold at a premium above the current spot price of gold. This premium covers manufacturing, distribution, and dealer markup. Compare prices from multiple local sellers to find a competitive rate.

Buyback Policies: Many reputable dealers offer buyback policies, allowing you to sell the gold bar back to them at a fair price if you ever need liquidity. This is an important feature to look for, as it can make selling your gold easier in the future.

Size and Weight Options: Decide on the size of the gold bar that best fits your budget and investment strategy. Bars come in various weights, such as 10g, 50g, 100g, and 1kg. Larger bars often have lower premiums per gram, making them a cost-effective option for long-term investments.

Counterfeit Protection: Authenticity is paramount, especially for larger investments. Reputable dealers offer certified gold bars, often in tamper-evident packaging with assay certificates, serial numbers, and hallmarks for verification.

Questions to Ask Before Buying

When you find a dealer and are ready to make a purchase, consider asking these questions to ensure a secure transaction:

What is the current premium above the spot price? This helps you understand the total cost of your purchase.

Do you offer buyback services? Knowing you have the option to sell the bar back in the future can be a helpful safety net.

Is the gold bar certified and tamper-evident? Certification and tamper-evident packaging protect you against fraud.

What is the brand and weight of the bar? Trusted brands with accurate weights ensure easier resale and liquidity.

Storing Your Gold Bar Securely

Once you’ve purchased a gold bar, secure storage is essential to protect your investment. Here are some popular storage options:

Home Safe: Investing in a fireproof and waterproof home safe can provide security and accessibility, allowing you to store your gold on your own property.

Bank Safe Deposit Box: A safe deposit box at a bank offers high security, though access is limited to banking hours. This option can be especially appealing for long-term storage.

Third-Party Vaults: Specialized vaulting services provide insured and professionally managed storage. Many of these services also offer tax advantages for storing gold in specific jurisdictions.

Selling Your Gold Bars Locally

If you decide to sell, having purchased gold bars from a local dealer may buy gold bars near me streamline the process. Here are some common options for local sales:

Bullion Dealers: Dealers who sell gold often buy back gold bars, providing a convenient and straightforward way to liquidate your asset.

Jewelry Stores and Coin Shops: Some jewelry stores and coin shops buy gold bars, though prices can vary. Be sure to inquire about their buyback policies in advance.

Pawn Shops: High-end pawn shops may also purchase gold bars, though they typically offer lower prices than dedicated bullion dealers.

Private Sales: Selling to another individual can sometimes yield higher returns, though it requires extra caution and verification to avoid fraud.

Final Thoughts on Buying Gold Bars Near You

Buying a gold bar locally offers numerous benefits, including security, immediate access, and the chance to establish a relationship with a trusted dealer. By carefully considering the bar’s purity, size, certification, and your storage options, you can make a smart investment that aligns with your financial goals.

Whether you’re just beginning to invest in gold or adding to an existing portfolio, buying gold bars “near me” can be a rewarding experience that brings you closer to tangible wealth and financial security.